Mogo Car Loans Calculator in Kenya

MOGO is a world-class financial company that specializes in used cars & new Boda Boda financing in Kenya. The company also offers logbook loans to its potential customers conveniently, quickly, and easily.

To use the Mogo car loan calculator, enter some details about the loan you’re considering, such as the loan amount, annual interest rate, and loan term (length of time you have to repay the loan).

To use the loans calculator, you can follow these steps:

- Visit the Mogo website and navigate to the Logbooks Loans Page.

- Enter the loan amount you want to borrow.

- Enter the annual interest rate you will be charged on the loan.

- Enter the loan term (length of time you have to repay the loan).

- Click the “Calculate” button to see the estimated monthly payment and total cost of the loan.

- Keep in mind that the calculator is just an estimate and the actual terms of your loan may vary.

Mogo Car loan requirements

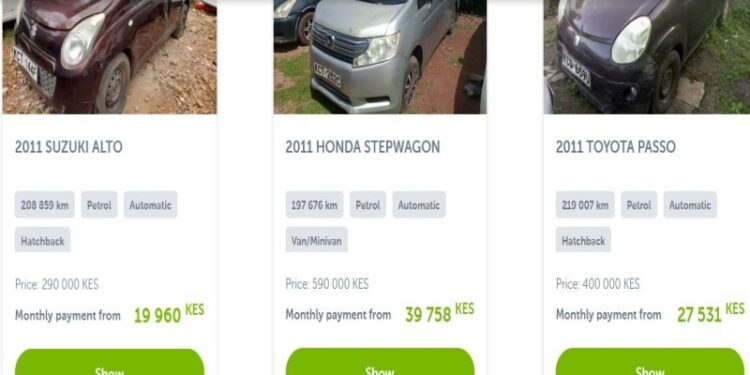

Mogo car loan financing is a way of buying a car with a loan. According to the contract, you and Mogo become the joint owner of the car you choose, and you become the user of the same car. When you repay all the fees according to your repayment plan, the ownership of the car is transferred to you.

You can apply for the amount of funding from Ksh 100,000 to a maximum of Ksh 2,500,000 with a repayment period of up to 60 months. The minimum down payment is 20%.

Mogo Car loan requirements

You will need these documents:

- Proof of income – 6 months bank statement

- M-Pesa statement

- Official payslip (if employed)

- Driver’s license

- Personal ID or passport

- KRA PIN

Full process:

- Pick a potential car to buy

- Fill out an online application or come to a mogo branch

- Preliminary loan offer will be made in 15 minutes

- Submit required documents

- Car is inspected by mogo valuer

- Contract is signed

- GPS is installed in the car

- Client makes down payment and adds mogo name to the logbook

- Money is transferred to the seller

When will I become a car owner?

The logbook will be jointly registered in your and Mogo Kenya’s names. After full repayment of your contract, you will be contacted by a MOGO employee to discharge the logbook to your name.

What happens in the event of an accident or theft of a car?

You are required to alert the appropriate authorities, your insurance provider, and Mogo Kenya LTD in the event of an accident or theft.

What happens if I cannot pay monthly payment on time?

If you think you cannot pay your monthly payment foreseen in the original repayment plan, please contact our customer support experts to offer you a proper repayment plan according to your needs.

How to apply for car financing through MOGO?

You can apply for car financing in several ways:

- Through this website, filling out an application by clicking here.

- By calling us at 0768 469 112

- By visiting one of our branches.

Read Also All you have to Know about Absa Savings Account

Frequently Asked Questions (FAQs)

What is the maximum repayment term?

You can apply for car financing services with a maximum repayment period of up to 60 months.

How do I pay a monthly installment?

You must make monthly payments in accordance with the repayment schedule outlined in your loan contract. To make things easier for you, any upcoming payments will be reminded via text message.

Will Mogo require proof of my income?

When applying for car financing, Mogo will ask you to submit the last 6 bank statements or other relevant documents proving the source and amount of income.

Questions about the car

How is car value assessed?

Mogo assesses the car’s value using internal valuers. Additionally, we employ a cutting-edge international assessment model with a sizable database that offers a precise valuation for each car.

Is compulsory auto insurance required?

All vehicles used in public places must comply with the requirements of the Motor Vehicles Act of Kenya and have third-party liability insurance. This means that a third party must be covered by a car insurance policy in the event of an accident.