All you have to Know about Absa Savings Account

Absa Bank Kenya Limited is a subsidiary of Absa Group Limited, a South African banking group. Absa Bank Kenya offers a range of savings accounts to meet the needs of its customers in Kenya. Some of the features of Absa savings accounts in Kenya may include:

Competitive interest rates: Absa may offer competitive interest rates on its Kenya savings accounts to help customers earn more money on their deposits.

Flexibility: Absa savings accounts in Kenya may include flexible features such as the ability to make deposits and withdrawals at any time, as well as the option to set up automatic transfers to assist customers in saving on a regular basis.

Convenience: Absa savings accounts in Kenya may be accessed via online and mobile banking platforms, allowing customers to manage their accounts and conduct transactions from any location.

Safety and security: Absa may provide a variety of security measures to protect the funds in its Kenyan savings accounts, such as protection against fraud and unauthorized transactions.

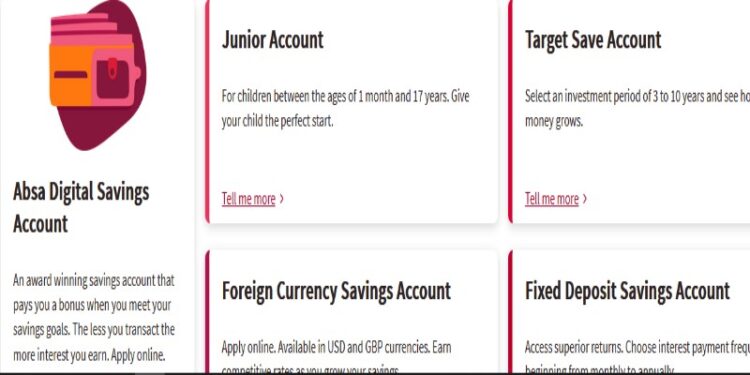

The following Savings accounts are available

- Junior Account: For children between the ages of 1 month and 17 years. Give your child the perfect start.

- Target Save Account: Select an investment period of 3 to 10 years and see how your money grows.

- Foreign Currency Savings Account: Available in USD and GBP currencies. Earn competitive rates as you grow your savings.

- Fixed Deposit Savings Account: Access superior returns. Choose interest payment frequencies beginning from monthly to annually.

Junior Savings Account

Invest in your child’s future by instilling the value of saving in them from a young age. You will be giving them a once-in-a-lifetime opportunity.

- Competitive interest rates starting from 7% interest per annum

- Access to fun and developmental activities centered on science, art, sports, travel and technology

- No charges

- Free piggy bank when you fund you Absa Junior Account

- Quarterly events focusing on science, technology, arts, theatre, sports, musicals

- Exclusive access to Absa Junior Partners with discounts and offers on events

- Access to education policies for long-term savings, medical insurance etc.

Documents Required

For the child:

- Original birth certificate or adoption papers if child is adopted

For the parent/guardian:

- National ID or passport (non-Kenyans)

- KRA PIN

Target Save Account

Save for education, a wedding, a dream car, a vacation, or any other goal. This account includes insurance that will pay your savings to your loved ones in the event of your death or disability.

- It is a long-term savings solution of up to 10 years

- You earn competitive interest rates on your savings

- Insurance cover contributes to your savings in case of death or permanent disability

- A free standing order helps you achieve your target

- No maintenance fees

- Target period from 1-10 years

Documents Required

- KRA PIN

- National identity card (Kenyan) or passport (non-Kenyan)

- 1 passport photo

Read Also Family Bank Contacts and Internet Banking

Foreign Currency Savings Account

Take advantage of the ease of opening an account online. Take only 10 minutes to get started with your application.

- No minimum balance required to open the account

- No Account charges

- Competitive interest rates. You earn interest when your balance is above USD/GBP 5,000

- Monthly interest, see below applicable rates with interests payable monthly

- No minimum balance required to open the account

- No Account charges

- Competitive interest rates. You earn interest when your balance is above USD/GBP 5,000

- Monthly interest, see below applicable rates with interests payable monthly

Documents Required

What you need to apply online

- KRA PIN

- National identity card (Kenyan) or passport (non-Kenyan)

- Signature specimen

What to bring if you apply at a branch

- KRA PIN

- National identity card (Kenyan) or passport (non-Kenyan)

- 1 passport photo

- Work/business permit (Non-Kenyans without KRA PIN)

Fixed Deposit Savings Account

Choose interest payment frequencies beginning from monthly to annually.

- Minimum balance required is Ksh 50,000 to open the account

- No Account charges

- Competitive interest rates

- Choose your interest payment frequency from monthly to annually

Documents Required

- National ID or passport (non-Kenyans)

- KRA PIN or work permit (non-Kenyans without KRA PIN)

Frequently Asked Questions ( FAQs)

- What is fixed account in Absa?

In an ABSA fixed account, you deposit a fixed amount of money for a specific period of time, during which you do not have access to the funds.

At the end of the term, you receive the deposited amount plus any interest earned. Fixed accounts are typically offered by banks as a way for customers to save money and earn a higher interest rate than a traditional savings account.

- Can I withdraw from my Fixed Account?

It is determined by the terms and conditions of the particular fixed account you have.

Some fixed accounts may permit withdrawals before the end of the term, but this may be subject to penalties or fees. Other fixed accounts may not allow withdrawals before the term ends.

- What is Absa fixed deposit rates?

Absa Bank offers a variety of fixed deposit accounts with varying terms and interest rates. The interest rate on a fixed deposit account is determined by the account’s term and the amount of money deposited.

Fixed deposit accounts with longer terms and larger deposits typically pay higher interest rates. Under certain conditions, Absa Bank may also offer special interest rates on fixed deposit accounts.