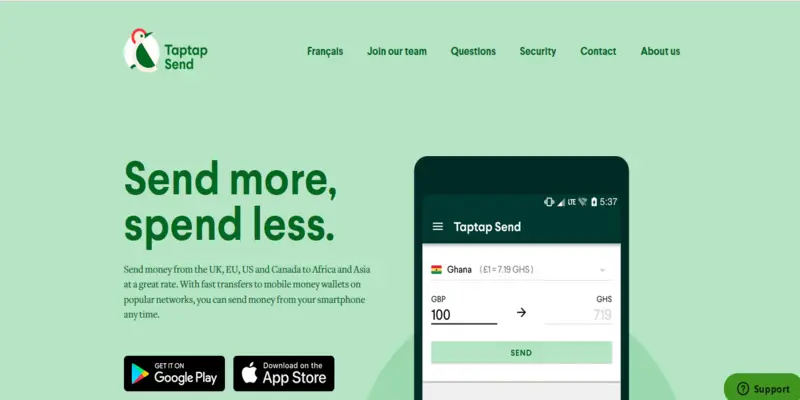

Taptap Send Guide,Taptap Send App , Customer Care Contacts

Today’s world calls for the need to come up with innovative ways to minimize costs while maximising the amount of money earned from various ventures.

Taptap Send is a company that was established in 2018 with an aim to make money transfer easy. It was specifically designed to allow people to send money to Africa and Asia at a lower cost than most money-transfer methods.

In addition to being affordable, this method is fast and isn’t affected by geographical barriers, as one can receive money, regardless of whether they live in urban centres or not.

The countries to which money can be sent include Kenya, Zambia, Vietnam, DR Congo, Ivory Coast, Cameroon, Sri Lanka, Pakistan, Nigeria, Ethiopia, Morocco, Ghana, Mali, Guinea, Nepal, and Mozambique, among others.

Below is a summary of how Taptap Send works, so that you are convinced that it is the best money-transfer option to choose.

Taptap Send App download

Follow the steps below to download the Taptap Send app:

- Visit the Google Play Store.

- Enter the app’s name on the search bar and click on the search

- Click on install.

The app will download in a few seconds (ensure your phone is connected to internet).

After downloading the app, you can now send money to your loved ones as below:

- Launch the Taptap Send app.

- Create an account by entering your information as prompted.

- Enter the name and phone number of your recipient.

- Click send.

Once the recipient receives the cash, they can choose to withdraw it from a mobile–money agent or bank, use it to pay bills, or buy airtime with their phones.

There is no difference between cash sent through Taptap Send, and that which they held in their account previously, so there are no usage rules.

Taptap Send limits

There is a limit to the amount that you’re allowed to send using the app, but this is dependent on the country to which you’re sending the money to and the mobile provider receiving the money.

However, Taptap Send has its own per-transfer limit that you cannot surpass as below:

- 2,000 US Dollars – comes with a daily limit of 2,999 dollars and a weekly limit of 24,000 dollars.

- 2,000 Euros.

- 999 Canadian Dollars – comes with a daily limit of 9,500 Canadian dollars and a weekly limit of 30,000 Canadian dollars.

- 1,800 pounds.

Again, you must consider the maximum amount that your recipient’s wallet can hold before sending money. Sending more money that it can hold will result in an unsuccessful transaction.

Below are examples of limits that come with sending money to 3 countries:

| Country/Wallet provider | Maximum sending | Wallet limit |

| Nigeria | No limits | No limits |

| Kenya/Safaricom | Daily – Ksh 300,000

Per transaction – Ksh 150,000 |

Ksh 300,000 |

| Bangladesh/bKash | Daily – 125,000 BDT

Weekly – 450,000 BDT |

Daily – 125,000 BDT

Weekly – 450,000 BDT |

Which cards can you use to send money through Taptap Send?

To transfer money to someone in Asia or Africa, you’ll have to add your card number, so that the amount can be credited from your account. Below are the cards which are allowed and those that you cannot use:

Allowed: PostePay (Italy only), Mastercard, Visa, Visa Electron, Bancontact (Belgium only).

Not allowed: Maestro in UK, American Express, Prepaid cards.

Read Also How to transfer money from PayPal to M-Pesa

TapTap Send Customer Care Contacts

To reach out to a customer care representative, navigate to Taptap Send’s website, click on contact us, and enter your details, after which you’ll receive a response via email.

Website: https://www.taptapsend.com/.