How Online Chama Works, DigiChama Guide

A chama can, in simple terms, be defined as a group that exists for investment purposes, where each person involved contributes a set amount of money. In the beginning, chamas were common among women, but they have gained popularity among men also in recent years.

There are no rules on how contributions should be used, as each group of people can decide how to handle their contributions, regardless of how little they may be.

How do online chamas work?

Like the term suggests, online chamas are run through the internet, meaning processes such as bookkeeping will not be done manually.

As a result, being part of an online chama will save you resources in terms of paperwork, and you’ll save a lot of time. Additionally, you can set goals, stipulating the future you anticipate for your chama and track progress.

This way, it will be possible to develop new strategies based on whether your progress is good or not. If you’re in a chama and haven’t considered automating it using platforms such as DigiChama, please do so.

DigiChama Guide

DigiChama is a platform that allows a group of people to run their chama-related activities smoothly and through the internet. To create an account, follow these simple steps:

- Click https://www.digichama.co.ke/. Doing this will direct you to DigiChama’s website.

- Click sign-up.

- Provide details like your name, email address, phone number, and create a strong password.

- You’ll be required to verify your email, after which you can create a chama and add members using their ID numbers.

- Depending on your conversations with the rest of the members, choose the chairperson, secretary, and treasurer.

DigiChama Features

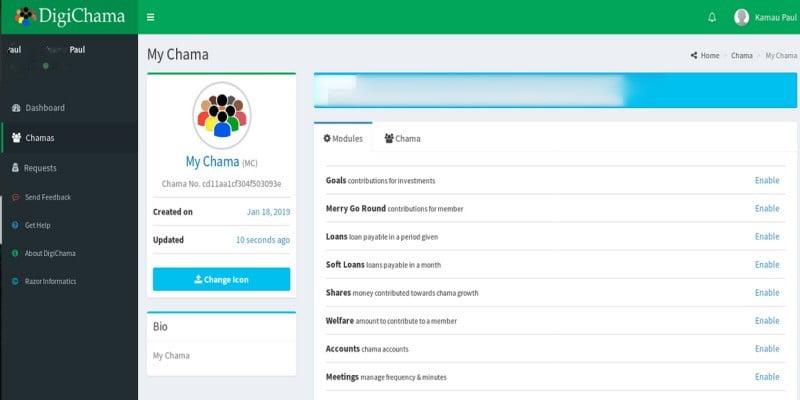

Here are several customizable modules/features:

Loans

Offers two categories of loans: Soft Loans, which are due within a month, and Normal Loans, which have a defined repayment period. All calculations are automated for smooth processing.

Merry Go Round

Efficiently oversees the most prevalent type of chama, where funds are contributed and allocated to members in a rotational fashion to promote development.

Shares

Also known as Savings, this module monitors a user’s investment in the chama. Contributions increase the chama’s financial resources or act as a foundation for obtaining a minimum loan.

Goals

This module, referred to as Investment, tracks contributions toward shared objectives. It offers insights into the progress of individual payments and highlights members who are falling behind.

Welfare

Allows members to donate funds to assist another member in need, promoting a spirit of community support.

Expenses

Enables effective oversight of group expenditures, assisting the chama in upholding financial discipline and ensuring transparency in the use of resources.

DigiChama Pricing

Free Tier

Kes 0 / forever

- No credit card required

- 10 Modules

- Credit Automation

- Unlimited Members

- Email Support

- Meeting Schedule For All

Standard

Kes 4,500 / yr

- No credit card required

- Penalties Module

- Custom Scheduling For Module

- Phone Support

- Online Training

- All in Free

Plus

Kes 15,000 / yr

- customize the system to fit you best

- Custom reports

- Staff (Non Member) to Manage

- Priority support

- On Location Training

- Custom modules

Once you’ve created the account, decide on matters like meeting frequency, goals to achieve, loan terms, and members’ contributions, among others.

Be sure to take the chama’s rules seriously because it all comes down to discipline. Failure to act accordingly increases the chances of other members to do the same, meaning your investment group may never thrive.