Loan apps in Kenya without Registration fee

There are many loan apps that are available in Kenya without registration fee.

Technological advancements have made it possible for individuals to achieve a lot through their smart gadgets.

For instance, you can acquire a loan from online vendors, saving you the hustle of visiting a bank and going through a tiresome process before your loan request gets approved.

You don’t have to worry about finding a suitable loan app because all you have to do is search through the internet and go through the features of each service that will result from your research.

When diving deep into each loan app’s characteristics, you’ll find that some require registration fees while others don’t.

Choosing a service that doesn’t charge any fees apart from interest on loans is beneficial as it will reduce the amount you’ll spend on your loan.

Loan apps without Registration fee

The following loans offer excellent services with no registration fee:

- Mshwari

- Timiza loan app

- Tala loan app

- Branch loan app

Below is a review of how each app operates and what to expect if you choose to use one loan app over the rest.

M-Shwari

This loan service resulted from a collaboration between M-Pesa and the Commercial Bank of Africa (CBA). You can only access M-Shwari if you are a Safaricom customer who is registered to M-pesa. Follow these steps to find out more about what this loan service has to offer:

- Launch Safaricom toolkit or MySafaricom app

- Click M-pesa

- Select the loans and savings option

- Click M-Shwari

By following these steps, you’ll find that you can request a loan, lock your savings, check your balance, and withdraw or deposit to M-Shwari . Remember that you must have used M-Pesa for more than six months and subscribed to Safaricom products such as mobile data for the same period.

M-Shwari loans come with an interest rate of 7.5%, and you must pay in 30 days, as failure to do this will result in challenges when borrowing in the future. When repaying, click the loan option under M-Shwari and select pay loan. There is no need to use a PayBill number, unlike other loan apps.

M-Shwari contacts are:

E-mail:

Facebook: https://twitter.com/SafaricomLtd

Timiza Loan App

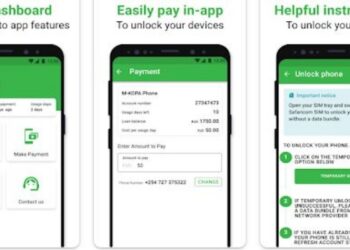

The Timiza loan app is a product by Absa bank that offers services to individuals whether they have accounts with the bank or not. There are two options regarding how to access Timiza loans. You can download the application from your play store or use a USSD code, which is.

If you choose to use the Timiza app, you’ll have to provide your Safaricom phone number and ensure it’s registered for M-Pesa services. Upon activation of your account, you’ll receive the maximum and minimum amount you can borrow.

At this point, you can request a loan. If using the USSD code instead, dial it and follow the instructions.

Once the Timiza team is done verifying your details, you’ll receive a notification on your loan limit after providing your ID number, and you can start borrowing.

When repaying your loan, you can use these options:

- M-Pesa PayBill – with this option, go to your M-Pesa menu, select Lipa na M-pesa, then PayBill, enter 300067on the business number slot, and your registered phone number on the account information tab. Upon filling in your repayment amount and PIN, confirm that the transaction is correct.

- Timiza app – Click on “my loans” on the app and follow the instructions.

- USSD – dial *848# on and choose the loan option, after which you should follow the prompts given by the system

Failure to pay your loan on time will result in additional charges, so be careful not to dishonour this requirement.

Read Also List of Real Estate Companies in Kenya

Timiza Contacts

Email: ,

WhatsApp Number: 0712233248

Tala Loan App

Tala loan app offers unsecured loans to eligible individuals, meaning you do not have to put up anything as security on a loan.

Download the app from the Google play store if you haven’t done so already. You’ll have to give permission for the app to access your contacts and SMSs, as this is how the Tala loan app will measure your creditworthiness.

Ensure to provide your M-Pesa registered phone number when creating your Tala loan app account. After downloading the app and providing your phone number, do the following:

- Provide additional information such as your name and ensure its correctness

- Wait for the app to verify your details

- On approval, you’ll receive your loan limit, which is a minimum of Ksh 500 for beginners

- Go ahead and apply for your first loan, which you’ll receive through your M-Pesa phone number

When repaying your loan, you can use the app or M-Pesa PayBill, which is 851900. If using the app, you’ll still be prompted to visit the M-Pesa menu, which is why you need a phone number registered to this service.

Tala loan Contacts

E-mail:

SMS: 21991

Branch Loan App

With an android phone and a registered M-Pesa phone number, you can easily access Branch loans. Follow these steps when applying for a Branch loan:

- Download the Branch loan app from your Google play store

- Use your M-Pesa mobile number to register yourself as a Branch member.

- Add details such as your national ID number, legal name, and date of birth.

- After authentication of your details, you’ll be automatically directed to a loans page.

- Determine your loan amount, which is usually a maximum of Ksh 1000 for new borrowers. This limit will go up with time, provided you pay your loan on time and apply many times.

- You’ll receive your cash through M-pesa

When repaying, use M-Pesa PayBill, which is 998608. You can also use your debit card, but you’ll have to add your details on the Branch loan app.

Branch Contacts

Email: .